Mortgage Refinance Deal Things To Know Before You Get This

Table of Contents5 Simple Techniques For Best Refinance DealsGetting My Best Home Loan Refinance Offers To Work4 Simple Techniques For Mortgage Refinance DealAll About Best Home Loan Refinance Offers

As a debtor, you might possibly conserve countless bucks over the regard to your funding when you secure a lower rate of interest (refinance deals). And in a lot of cases, a reduced rate of interest likewise means a lower month-to-month home mortgage repayment. This passion savings can enable you to pay off various other high-interest financial obligation, contribute to your interest-bearing account or place more bucks toward retired life

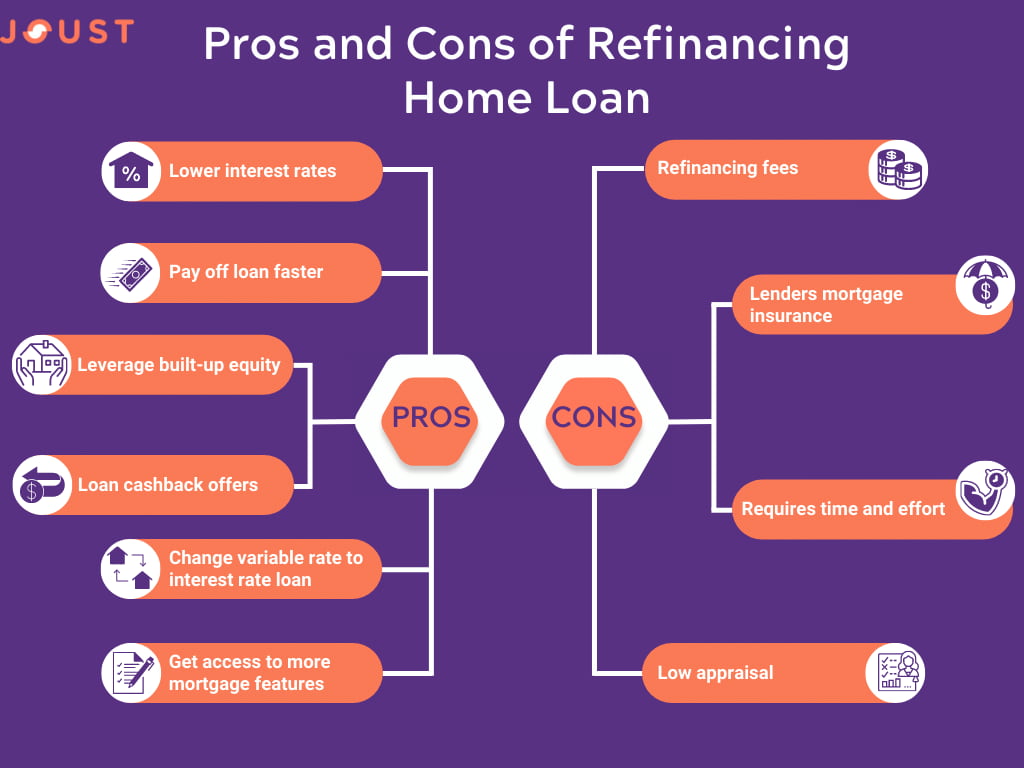

Re-financing your mortgage might feel like a complicated possibility, yet doing so could conserve you thousands on your home loan. Like anything, it does not come without its risks, so inspect out our benefits and drawbacks list to see if it may help you. One of the largest advantages of refinancing is to make the most of a lower rate of interest.

You could use this money on crucial or non-essential products, or remain to pay at the degree of your previous repayments and settle your funding quicker, saving you on passion. Refinancing your home mortgage suggests you might have the alternative to minimize the size of the funding. Keep in mind this will possibly increase your regular monthly settlements, but if you remain in a setting to do so, paying your financing off quicker is most likely to save you on rate of interest over the life of the finance.

How Best Refinance Offers can Save You Time, Stress, and Money.

Your monthly repayments will certainly enhance however you will likely conserve thousands on rate of interest. Make certain you do the math to see just how much you would conserve on interest to guarantee this approach works for you. Home equity refers to the difference in what you have actually repaid on your car loan and the worth of your home.

When you re-finance your home your loan provider may enable you to access some or all of this equity, which you can utilize nonetheless you desire. It's typical for customers to access their equity and utilize it for points like remodellings, holidays, a cars and truck, or investing. Keep in mind your equity is an effective device in negotiating with your loan provider, and can help you to acquire accessibility to a far better interest rate.

A redraw facility permits you to make added settlements on your funding and revise these if required, at the discretion of the read this post here lending institution. A balanced out account is a wonderful way to minimize rate of interest on the car loan, while a revise facility can be helpful in an emergency situation or if you need to make a huge acquisition.

The Best Strategy To Use For Refinance Deals

If you're currently on a variable rate car loan refinancing implies you may be able to change to a set price, and vice versa. With rates of interest at record low for a number of years, you may choose repairing your finance is the method to visit provide you capital certainty. Or, you may believe rate of interest might go lower, so you want to change to a variable price and have some adaptability.

In the existing atmosphere, no resident can pay for to just think their useful source funding uses excellent value. If you have actually had your funding for a couple of years, chances are, there could be scope for you to conserve. By protecting a cheaper rate of interest rate and reducing your regular monthly repayment, you can be entitled to even more cost savings than you realise.

It's worth knowing it doesn't need to take 25 or three decades to pay off a home. Below are some top pointers you'll intend to read that can just help you Refinancing is usually utilized to liberate the equity you have in your existing home in order to money purchases or way of life goals.

Just how much equity you can make use of will range lending institutions, which is why having a home lending specialist on your side can make all the difference when it pertains to doing the research. Figure out even more regarding accessing your home's equity..

The Best Strategy To Use For Best Refinance Deals

Australian interest rates are on the surge. Lots of previously comfy house owners might be feeling the pinch as lending institutions pass via that money rate in the kind of higher passion rates.

With rate of interest on the rise, there's never been a much better time for Australians to make the important source switch to a home mortgage with a far better rate of interest, or make the relocate to a brand-new supplier with fewer charges. You can refinance your mortgage with your present bank, a new lender, or also a home mortgage broker.

A lower interest rate can conserve you hundreds of bucks over the life time of the car loan. Switching to a home loan with a reduced rate of interest can also possibly assist you repay your home mortgage faster. If you get a better rate of interest and remain to make the same payments as you did on your old lending, you'll reduce the regard to your car loan.